The wave of CMBS maturing loans that were created at the height of the real estate bubble will crest in 2016 and 2017. According to estimates by Trepp, nearly 20% of these maturing commercial mortgages will demand additional capital from current borrowers or new buyers when the loan is refinanced or the property is sold.

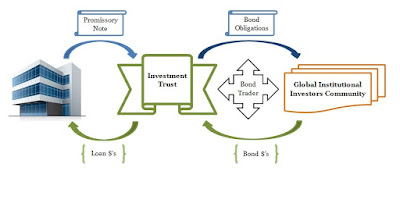

How Does the CMBS Market Work?

New risk retention rules coming into play in 2016 require that either the originating lender will have to hold a certain piece of the loan for at least 5 years and/or the B-piece buyer will have to hold the paper for that amount of time. As B-piece buyers aren't set up to comply with these regulations, they will be forced to create processes to handle, which will result in increased cost passed on to the borrower in the form of higher spreads.

Meanwhile, CMBS spreads are drifting wider with a recent 10-year AAA bond clearing at 140 basis points over swaps. This ongoing weakness has led some issuers scheduled to price this year to push off their deals until later in 2016.

Non-Bank Balance Sheet Lenders

Since 2008 a sizable contingent of non-bank balance sheet lenders have sprung up and they unencumbered by banking regulations, legal lending limits, or geographical footprint. They keep all loans in-house and rarely outsource underwriting or servicing to third parties. Permanent loans offered by non-bank lenders provide long-term financing for stabilized commercial real estate, with loan terms up to 20 years and without the hurdles of defeasance. Bridge loans by same lender are designed for un-stabilized properties or shorter term business plans and include leading-edge features such as additional future facilities for lease-up costs and loan terms up to 7 years. Most non-bank lenders make non-recourse loans

Non-Real Estate Collateralized Lenders

Perhaps one of the oldest lending communities, non-real estate collateralized lenders offer flexible loans secured by a myriad of assets, including securities, business and real estate equity, etc. The closing processes are simplified and with lower costs. Financing may be used in combination with real estate backed loans.

To prepare for the coming wave please contact Redmount Capital Partners or learn more about our capabilities.

__________

Clicking the Like button on various social media platforms, such as LinkedIn, Facebook, etc. does not constitute a testimonial for or endorsement of Redmount Capital Partners LLC or any Investment Advisor Representative. “Like” is not meant in the traditional sense. Posts must refrain from recommending investment advisory services or providing testimonials for our firm, since they are strictly prohibited. Please understand that we are required to delete such posts, since this is a regulatory requirement.