US

Starting with the US economy, which began the year on the wrong foot, we believe the weakness of the first quarter is temporary in nature, mostly due to exceptional factors. US GDP is reported to have contracted by 0.2% in Q1, though there could be revisions to this estimate. The pace of activity was held back by harsh winter conditions, disruptions to ports on the West Coast, reduced energy investment following the decline in oil prices (which subtracted about 0.5 percentage points from Q1 growth), and weaker exports held back by a stronger dollar. Moreover, seasonal adjustment techniques in the official statistics have resulted in Q1 growth systematically reported as much lower than the full-year average.

Both oil prices and the dollar have stabilized; as a consequence, the supply adjustment in energy markets has decelerated: The number of rigs in operation continues to decline but at a much slower pace, and the drag on exports (equivalent to about 0.6 percentage points for every 10% real appreciation) should have largely run its course. Meanwhile, the labor market continues to improve, with new job creation in the non-farm sector running at a 3-month average of about 200,000; the unemployment rate has declined to 5.3%, close to the Congressional Budget Office’s estimate of the non-accelerating inflation rate of unemployment (NAIRU).

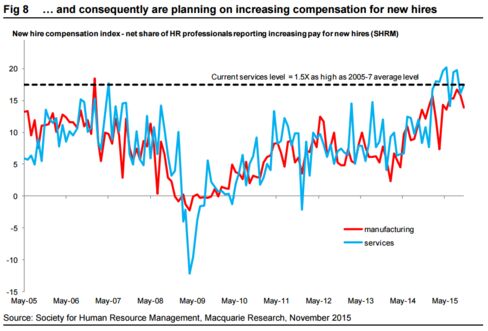

A tighter labor market has begun to exert pressure on wages. The Employment Cost Index accelerated to 2.6% year-over-year in Q1, the highest pace since 2008; wages and salaries were up 5.0% year-over-year in May. Core inflation has remained stable at close to 1.5%; the base effects from lower oil prices will begin to fade by August, and the recent pickup in oil prices will then gradually push headline inflation closer to core; wage pressures are then likely to translate into more significant price increases over the remainder of the year and into 2016.

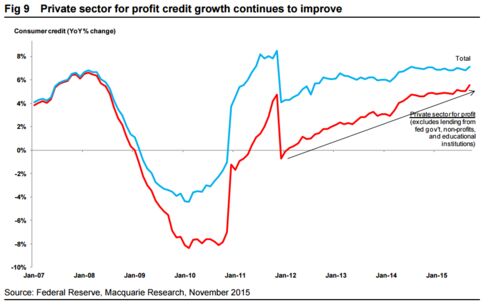

Overall, these data make us confident that the US recovery remains on track. This in turn should lead the Fed to hike interest rates later this year, most likely in late Q3 or in Q4. Financial markets have begun to anticipate the likely move, with 10-year Treasury bond yields rising from about 1.64% at the end of January to about 2.35% by the end of June. Markets are, however, pricing a slower pace of monetary policy tightening than the Fed itself has indicated. While the central bank will likely start tightening at a slow pace, it might need to move faster once inflation pressures build up; this would imply an even larger disconnect from current market expectations.

Europe

Eurozone growth has surprised on the upside in Q1, as we had predicted in our previous Global Macro Shifts publication. At +0.4%, Q1 marked the 8th consecutive quarter of positive quarterover-quarter (qoq) growth. The pickup in economic activity has been spurred, most importantly, by a weaker euro, which has boosted the competitiveness of eurozone exporters. QE by the European Central Bank (ECB) also helped, by reducing funding costs and pushing more liquidity into the banking system. Recent indicators suggest that positive momentum persists: Purchasing manufacturers index, retail sales and lending indicators all remain on an uptrend.

Though most of the eurozone has seen a broad-based pickup in activity, the sustainability of this varies across countries. Spain, for example, has been outperforming on the back of its reforms and the efforts made to put public finances on a sounder footing. Germany maintains strong international competitiveness, currently buttressed by a healthier domestic demand. Germany’s trade surplus runs at about 7% of GDP, proof of its enduring export prowess. In France and Italy, however, the acceleration seems more cyclical in nature; both countries need a more determined reform effort to accelerate growth on a more sustainable basis.

The recently launched QE program has successfully begun inverting the previous contraction of the ECB’s balance sheet, which shrank by as much as one third from its peak. Together with existing programs for the purchase of covered bonds and ABS,1 QE has boosted the central bank’s balance sheet by about €200 billion (bn), compared to a target of about €1.1 trillion (tn) as of June 30. Some analysts and market players have speculated that the ECB might abandon its QE program in the near future, given the stronger-than-expected pace of growth. ECB President Mario Draghi, however, has repeatedly emphasized that the bank intends to carry out its program at least until September 2016, and that in any event it would need convincing evidence that inflation is converging to its 2% target in a sustainable way before considering a policy change.

The Greek saga remains the main cloud on the horizon of the European recovery. Greek voters rejected the latest creditors’ proposal in a referendum held on July 5. The referendum asked voters to either accept or reject the latest economic program that resulted from six months of difficult negotiations with the European Union, ECB and International Monetary Fund (IMF). Eurozone leaders had warned that a “no” vote would most likely result in Greece exiting the eurozone. While negotiations are expected to resume, the risk of “Grexit” has substantially increased. Rather than predicting the outcome of these discussions, we prefer to focus on the possible consequences of the worst-case scenario. Should Greece leave the euro, we believe this would cause a temporary shock to financial markets, with peripheral spreads widening in the eurozone, and a spike in global risk aversion. We are also confident that the eurozone’s current firewalls are strong enough to limit contagion, so that the adverse impact should be limited and temporary in scope.

Japan

Japan appears to be finally succeeding in its struggle against deflation. Core CPI is running at about 2%, even subtracting the impact of tax hikes. Even the collapse in oil prices has not been enough to push the country back into deflation, and nominal GDP growth remains on a healthy uptrend. Japan’s success in keeping inflation in positive territory is especially remarkable given the extremely adverse external environment, where many countries have experienced deflationary pressures. This constitutes very encouraging evidence that the “first arrow” of Abenomics, namely a much more decisive QE push, has proved effective.

The positive impact of Abenomics can be seen on output growth: GDP expanded faster than expected in Q1, at over a 2% qoq seasonally adjusted annualized rate. Inventory accumulation played an important role, but there were also encouraging signs of a rebound in both private consumption and capital expenditures. Moreover, output prices have been running significantly above input prices, indicating that profitability will likely improve, which would support the outlook for a further pickup in investment. Last year’s tax hike, therefore, has not stopped the recovery, contrary to what a number of analysts feared, especially given that a tax hike derailed Japan’s attempt to exit deflation in 1997. This tax hike, the cornerstone of the fiscal strategy, therefore, was a calculated but courageous gamble—and has paid off. This should be considered as another major success of the government’s policy: The “second arrow,” a prudent fiscal policy, promotes confidence in long-term debt sustainability.

The “third arrow,” structural reforms, remains the most important part of the equation—and has been the focus of most questions and skepticism since the launch of Abenomics. In this area, some important progress has already been made. On the financial side, the portfolio rebalancing of the Government Pension Investment Fund has begun spilling over to other institutions, such as Japan Post and the public employees’ pension funds. Probably more important are efforts to strengthen corporate governance through improving transparency and encouraging a more active role by shareholders and corporate boards.

Japan’s productivity, after running at about 3% in the 1980s and about 2% in the 1990s, now languishes at a mere 1%. Weak corporate management practices and the ensuing inefficiencies are the main culprits for this productivity slowdown. Japan must boost nominal GDP growth on a durable basis to guarantee the sustainability of its massive debt burden. Besides a permanent rise in the inflation rate, this requires stronger overall real GDP growth. This must be achieved in the face of intensifying demographic pressures, as Japan’s population will continue to age rapidly in the coming decades. Government programs to boost the labor force, in particular by raising female participation, can help, but will not fully offset the impact of aging. To achieve stronger real GDP growth therefore, Japan must achieve faster productivity growth, importantly requiring a strengthening of corporate governance. Japan has therefore adopted a new corporate governance code, which formalizes explicit responsibilities for corporate boards to scrutinize management and communicate information to shareholders, and requires every board to have at least two external directors. Much more work will be needed to increase flexibility and boost productivity, but the measures already taken confirm that the government realizes that it must attempt to tackle the toughest reforms, even if this means clashing with powerful vested interests.

_____________________________________________

Clicking the Like button on various social media platforms, such as LinkedIn, Facebook, etc. does not constitute a testimonial for or endorsement of Redmount Capital Partners LLC or any Investment Advisor Representative. “Like” is not meant in the traditional sense. Posts must refrain from recommending investment advisory services or providing testimonials for our firm, since they are strictly prohibited. Please understand that we are required to delete such posts, since this is a regulatory requirement.

Click the graphic to enlarge

Click the graphic to enlarge Click the graphic to enlarge

Click the graphic to enlarge