"Despite a strong employment report for October, doubts persist in some corners about the resilience of the U.S. economic expansion," they wrote. "We remain confident in the outlook and believe strength should continue in equities with disproportionate exposure to the U.S. economy."

Macquarie is often correct in projecting global and macroeconomic trends. The firm has succeeded as the foremost infrastructure investor, globally, in part by seeing well the big picture.

To this end, Macquarie analysts compiled a list of 10 reasons why the American economy is better than you think.

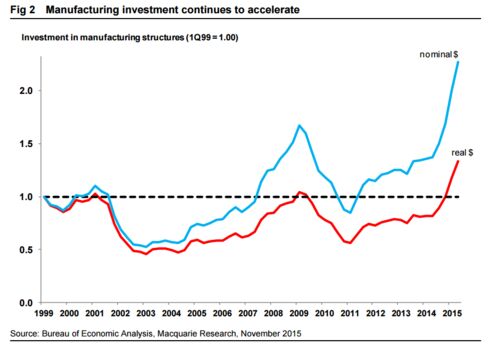

1. The U.S. manufacturing renaissance is alive

You wouldn't know it from the widely-cited ISM manufacturing purchasing managers' index, which suggests that the secondary sector is barely eking out any growth, but structures investment in this segment is booming:

"Nominal investment in this area is up over 60 percent year-over-year and has more than doubled since 2012," the analysts wrote. "Manufacturers are increasingly building new plants and making improvements to existing plants.

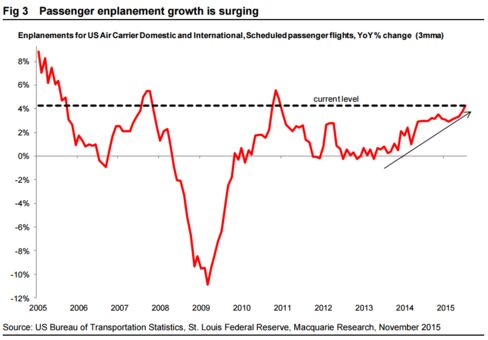

2. Air travel is taking off

Cheap fuel, the lofty U.S. dollar, and an improving economy have served as tailwinds for miles flown domestically and abroad to surge:

"Enplanement growth is accelerating and has reached its fastest pace of growth in five years," wrote Doyle and Livingstone.

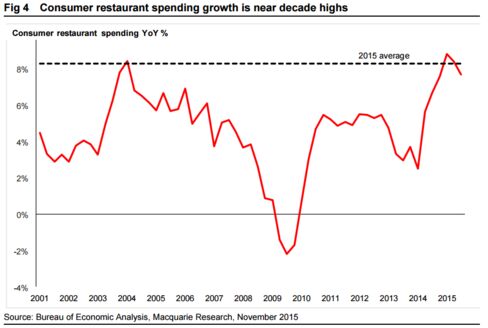

3. People are going to restaurants

Another clear beneficiary of the plunge in gas prices: restaurateurs. Nine readings into 2015, the average annual growth is running at roughly its peak rate during the previous cycle:

4. Consumers are increasingly optimistic

A sub-component of the University of Michigan consumer sentiment survey shows that the net percentage of respondents who expect their financial situation to be better in a year has hit its highest level since 2007:

This bodes well for future spending growth, according to the analysts.

5. Workforce entrants come with caps and gowns

"Over the past two years, a net 3.5 million workers with bachelor degrees or higher have entered the labor force, while a net 1.1 million workers with less than this level of education have departed from it," wrote Doyle and Livingstone.

The negative impact that the slowing in labor force additions has on gross domestic product growth may be somewhat offset by higher productivity from these better-educated employees. An environment in which well-educated workers drive labor force growth also augurs well for a reduction in income inequality, as those offering jobs that require fewer prerequisites find that the pool of available workers has shrunk, at least in relative terms.

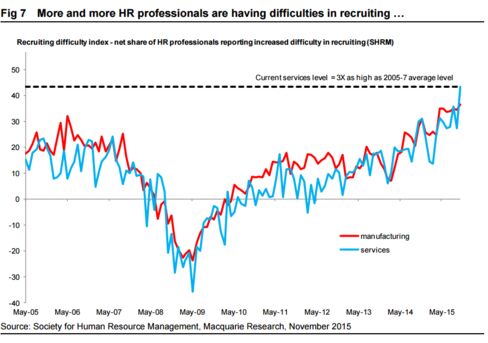

6. The labor force is tight ...

A survey of Human Resource executives shows companies are having trouble finding new prospects:

Slack in the services sector, by far the dominant portion of the American economy, is particularly scarce, compared to the previous cycle.

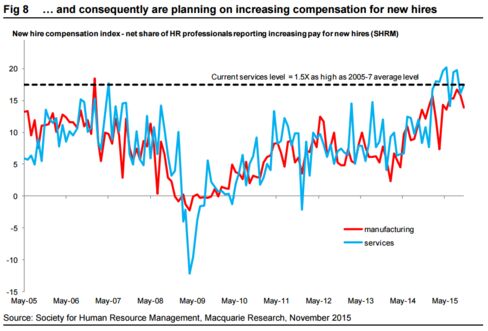

7. So new hires are getting pay raises

Unsurprisingly, the dearth of good talent has resulted in new hires getting pay raises "well above the average from 2005 to 2007, yet another sign of a tight labor market," the analysts wrote.

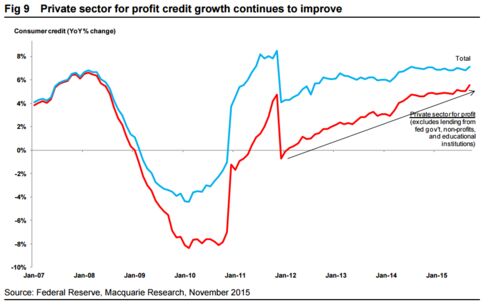

8. Private sector credit growth pushing higher

"While headline consumer credit has been stable at 7 percent year-over-year, this masks firming fundamentals," wrote Doyle and Livingstone. "Credit growth from the federal government and not for profits has been decelerating, while credit growth from private sector for profit lenders has been rising steadily."

9. Robust investment in innovation

The growth in research and development expenditures has eclipsed its pre-recession pace, moving steadily higher since 2012:

10. Producer price inflation is hotter under the hood

While market-based measures of inflation compensation suggest that fears about deflation can remain elevated, producer prices tell a different story. Excluding food and energy, the core producer price index is up a healthy 2.1 percent, year-over-year, Macquarie observes:

Source: Macquarie, Bloomberg

Note: Information contained herein has been obtained from sources believed to be reliable, but Redmount accepts no responsibility or liability (including for indirect, consequential or incidental damages) for any error, omission or inaccuracy of such information. The projections shown are provided for informational purposes only and should not be construed as investment advice or providing any assurance or guarantee as to returns that may be realized in the future from your private equity commitments. Projections and expected returns are subject to high levels of uncertainty regarding future economic and market factors that may affect future performance.Accordingly, such projections/expectations should be viewed as only one possibility out of a broad range of possible outcomes.

__________________________________________

Clicking the Like button on various social media platforms, such as LinkedIn, Facebook, etc. does not constitute a testimonial for or endorsement of Redmount Capital Partners LLC or any Investment Advisor Representative. “Like” is not meant in the traditional sense. Posts must refrain from recommending investment advisory services or providing testimonials for our firm, since they are strictly prohibited. Please understand that we are required to delete such posts, since this is a regulatory requirement.